After you have determined whether or not you have any particular sales tax obligations in a specific state, it is essential that you register your business with the relevant tax collection authority of the state or other local tax centers. A lot of states offer business owners certain benefits like requiring a registration within a month, two months or even 3 months after crossing the economic nexus threshold.

In some states, it is mandatory to register and collect and then remit sales taxes immediately after the threshold gets crossed in the next invoice. In this small article, you will learn about the different rules involved in registering your company for sales taxes.

The process of registering

Registering is a more or less easy procedure. You would have to provide to the tax department some specific information which includes the name and address of your business, documents which identify you as the owner like your driver’s license or social security number, federal identification numbers and so on. A

long with this, you need to provide an estimated monthly sale amount in the state. States charge a certain fee for registering sales tax permits. States like California and Florida however do not charge any fee. A lot of rules and regulations about sales taxes may change often and hence, it is important to check up with the tax departments to get the most recent information.

Registration process for multiple states

Business owners will have to register their company in several states if they want to run a bigger company that caters to customers throughout the country. There are in place specific registration systems which can help you to get tax registration done in an easy and effective way in over 23 states which have taken active participation in the program. These registration systems can help you reduce your costs and the burdens of your sales and tax compliance procedure immensely. Certain states even actively encourage business owners to use these systems and offer sales tax refunds for installing the specific software systems.

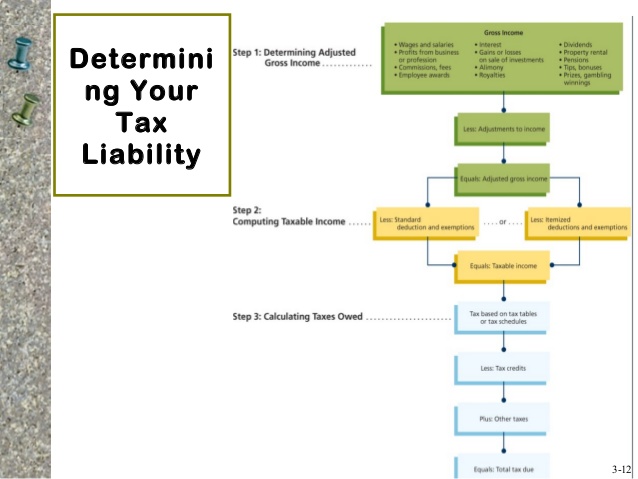

Determining your tax liabilities

After you have registered your company in a specific state, you would have to determine which of the products that you sale are actually taxable and which have been exempted. Based on this, you will need to calculate your sales tax amount on the taxable transactions. A lot of the transactions are taxable in states like South Dakota, Hawaii and New Mexico but several other states offer a lot of exemptions with regards to sales taxes.

For instance, services relating maintenance of personal property, information services are levied with a sales tax in states like Texas while services like haircuts, which are personal in nature, are not taxes. In the state of Florida, there are taxes for recreation services and amusements however services which are provided on personal property like maintenance repairs are untaxed.

Similarly, North Carolina levies taxes on installation, repair, painting and maintenance services while several other services are exempted. Personal property which is tangible is taxable but certain states do not follow the rule. In Minnesota, things like sports equipment, fur coats are taxed while jeans and t-shirts have exemptions. Similarly, digital products in the form of eBooks, streamed movies and music are taxed in Pennsylvania but exempted in California.

What is the procedure for calculating Sales Tax?

The amount of sales tax that you have to pay will vary by locations. There are over thirteen thousand different sales tax jurisdictions in the country. A lot of states will base their sales tax rates on specific places where consumers take possession of products and services, while some sales tax regulations levy the tax depending upon the location of the sellers.

Some even combine both of them. In addition to this, some states levy taxes on logistical services like shipping and handling fees also. You may use an online sales tax calculator to help you calculate your sales tax amounts in a precise and accurate manner.

Conclusion

Calculating sales tax can be very tiresome and overwhelming. But once you are aware of the rules, things will start to become easier. You may also use online tools for calculating your sales tax. Hopefully, the information mentioned in this article will have helped you.